where's my unemployment tax refund tracker

Check My Refund Status. Enter the following four items from your tax return to view the status of your return.

What You Should Know About Unemployment Tax Refund

IR-2021-71 March 31 2021 To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and summer.

. Account Services or Guest Services. Wheres My Refund is updated once daily usually. Property Tax Relief Programs.

There are two options to access your account information. Solution found By logging in you can check under View. If you chose to receive your refund through direct.

The deadline for filing your ANCHOR benefit application is December 30 2022. The systems are updated once. You may check the status of your refund using self-service.

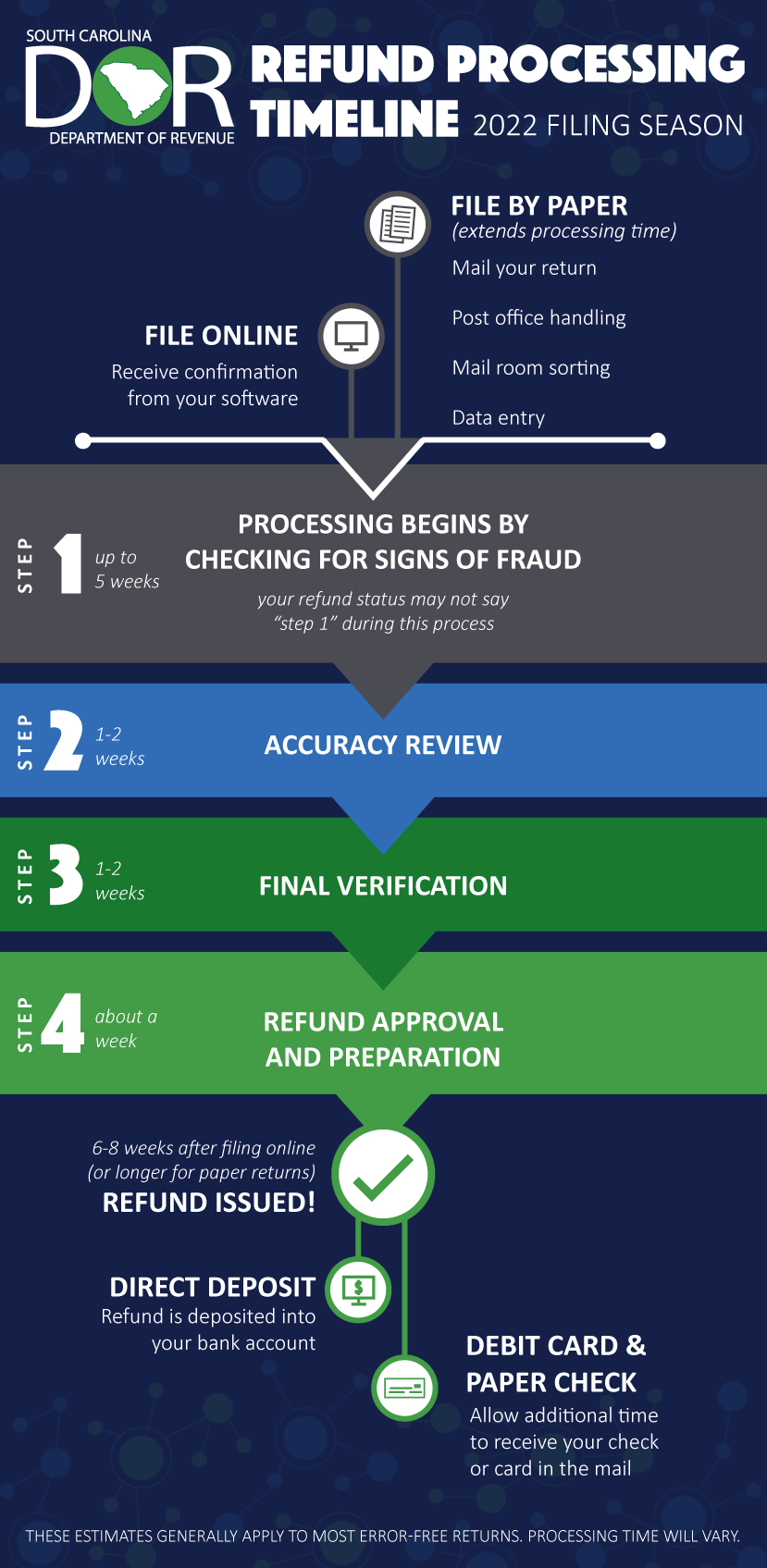

The IRS should issue your refund check within six to eight weeks of filing a paper return. This is the fastest and easiest way to track your refund. See reviews photos directions phone numbers and more for Where Is My Refund locations in Piscataway NJ.

You can try the IRS online tracker applications aka the Wheres My Refund tool and the Amended Return Status tool but they may not provide information on the status of your. How To Track Unemployment Tax Break Refund. Every 24 hours the systems are.

We will begin paying ANCHOR. Will display the status of your refund usually on the most recent tax year refund we have on file for you. Indicates required field.

If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records. See reviews photos directions phone numbers and more for Wheres My Refund locations in Piscataway NJ. The first social security number shown on your tax return.

To check your return online use the Wheres My Refund service or the IRS2Go mobile app. If you use Account Services. This is the most efficient and easiest way to track your return.

The answer depends on how you filed your return. If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records. Solution found How To Track Unemployment Tax Break Refund.

Use the Wheres My Refund tool or the IRS2Go mobile app to check your refund online. Taxpayers can track their refund using Wheres My Refund on IRSgov or by downloading the IRS2Go mobile app.

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

H R Block Good News Up To 10 200 Of Your Unemployment Income Could Be Tax Free The Irs Will Automatically Adjust Your Taxes And Any Refunds Will Start Going Out In May

Irs Sends First Unemployment Tax Refunds But Automatic State Refunds Are In Limbo Mlive Com

Year End Tax Information Applicants Unemployment Insurance Minnesota

The 2022 Tax Season Has Started Tips To Help You File An Accurate Return Internal Revenue Service

2020 Unemployment Tax Break H R Block

I Got Unemployment In Florida How Will My Taxes Be Affected Firstcoastnews Com

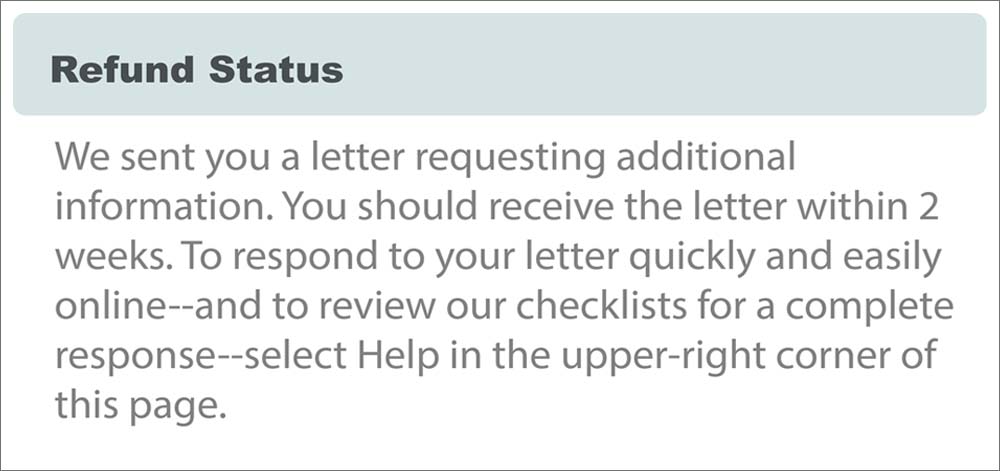

Respond To A Letter Requesting Additional Information

Where S My Refund Tax Refund Tracking Guide From Turbotax

Where S My Tax Refund Why Irs Checks Are Still Delayed

Tax Refund Delay What To Do And Who To Contact Smartasset

How To Track Tax Refunds And Irs Stimulus Check Status Money

If You Got Unemployment Benefits In 2020 Here S How Much Could Be Tax Exempt Abc News

/Balance_Tax_Refund_Status_Online_1290006-9f809670a73041a7a6caa96dd5592c99.jpg)

Trace Your Tax Refund Status Online With Irs Gov

Where S My Refund Track My Income Tax Refund Status H R Block

Wmr And Irs2go Updates And Status Changes Return Received Refund Approved And Refund Sent Aving To Invest